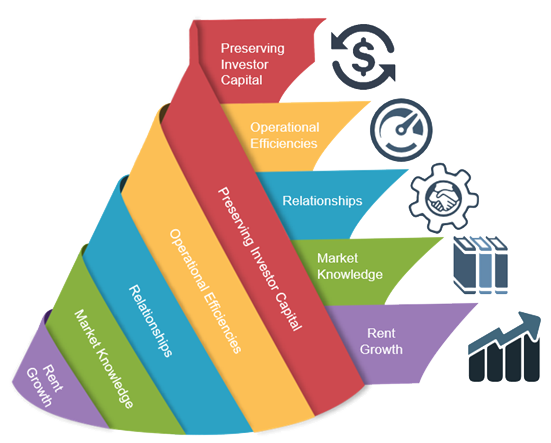

Philosophy

Strategy

- Disciplined and granular underwriting on each investment – buy right

- Alignment with investors – cash flow oriented, not fee focused

- Investors paid first

- Optimization of property operations – increased property cash flow

- Long term investor relationship – accessible management team

- Transparency on all investments – Property visits and market tours available

- Leverage management’s experience to create opportunities

- Value-add and opportunistic investments

- Below intrinsic value and market rent

Approach

- Demographic data and demand dynamics

- Land use planning and legislation (urban growth boundaries)

- Zip code specific market tracking

- Neighborhood gentrification

- Comparable cap rates

- Comparable rental rates

- Rental costs per square foot

- Price per square foot compared to sales and replacement costs

Target Areas

LMDG targets key submarkets in the Los Angeles and Orange County areas

- High effective rents and consistent rent growth

- Occupancy rates greater than 90%

- Limited new supply

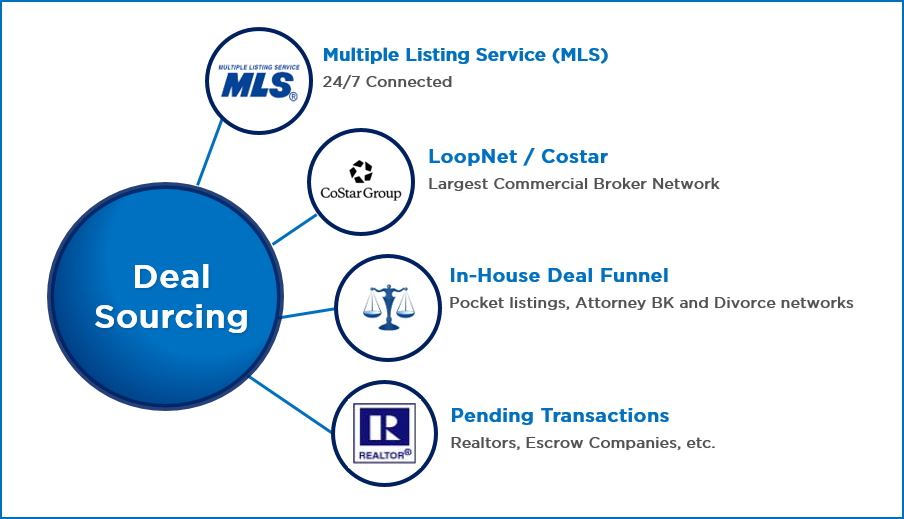

Pipeline

Criteria

| Property Type: | Multiamily, or under utilized commercial properties |

| Acquisition Size: | $1,000,000 – $7,500,000 |

| Target Leverage: | 50% LTV post renovation |

| Target Returns: | 7% – 25% stabilized cash yield |

| Locations: | Southern Caliornia. Los Angeles & Orange Counties |

Value-Add Opportunities

- Maximize cash flow with increased rents and operational efficiencies

- Upgrade unit interiors and modernize building exterior and common areas

- Complete extensive deferred maintenance or major repairs

- Leverage zoning and redevelopment potential